Your Gas Bill

Most customers receive a gas bill from their supplier once every 2 months. We explain the key information and terms on your bill.

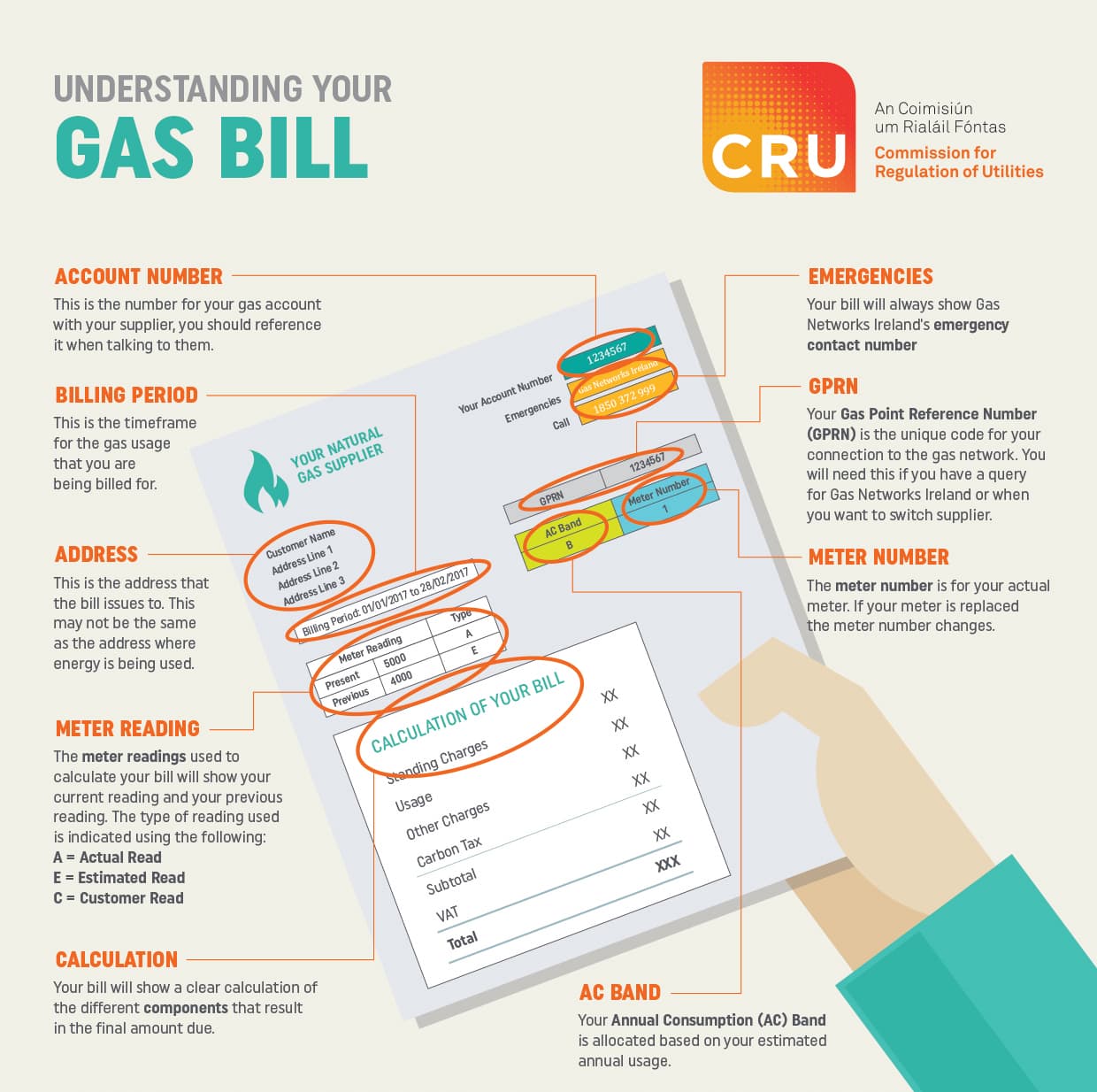

Understanding your gas bill

We know that many customers find it difficult to understand their gas bills. This guide helps to explain some of the important pieces of information on your bill.

Suppliers must include certain information on your gas bill to make it clear and easy to understand. Not all suppliers’ bills will have the information in the same place as this sample bill.

What the additional terms mean

Below is a brief explanation of some of the other pieces of information you will find on your gas bill.

Standing charges

This charge is applied for each day of the billing period. A billing period is generally about two months or 60 days, however this can vary.

Usage charges

Your usage is calculated using your meter readings. The difference between your current read and your previous read shows the amount of gas you used in cubic meters (m3). This is multiplied by the conversion factor to calculate the amount of energy used in kilowatt-hours (kWh). This number is multiplied by the gas unit rate to calculate the usage charge on your bill.

Conversion factor

The conversion factor is used to convert the volume of gas used (m3) into the energy value of the gas (kWh). The conversion factor changes based on the energy content of the gas in the network.

The energy content of gas may change depending on where it comes from, this is why there may be differences in the conversion factor from bill to bill. Gas Networks Ireland is responsible for calculating the conversion factor and they pass this information on to suppliers who use it when calculating customer bills.

Other charges

From time to time there may be other charges applicable to your bill. This may relate to items such as site works charges undertaken at your property by Gas Networks Ireland. If you are unclear about any charge, you should contact your supplier.

Carbon Tax

The Carbon Tax was introduced in May 2010 and applies to all supplies of natural gas to customers.

VAT

Value Added Tax is added to the costs of your bill at a rate of 13.5%.

Supplier contact details

Your supplier’s contact details will be on the bill. If you have any questions about your bill or if you are experiencing any payment difficulties, you should contact your supplier. They should be able to help you with any issues you are experiencing.

Complaints handling information

The bill will include a brief description of your supplier’s complaints handling procedure and related contact details. It will also highlight your right to bring any unresolved complaint to the CRU.